How America’s Largest Living Generation Shops Amazon

There’s no question that Amazon has become a go-to resource Tor the online purchase of tech products. Given the importance of Amazon as a point of sale location to consumers, we wanted to better understand how consumers, and particularly millennials, are using Amazon and the touchpoints that should matter most to brands seeking to optimize their Amazon sales channels.

Millennials Choose Amazon Over

Sex and Alcohol

Millennials would give up sex and alcohol for one year versus giving up Amazon

%

would choose Amazon over Alcohol

%

would choose Amazon over Sex

Millennials Unlikely to Buy If It’s

Not On Amazon

Fewer Than 1 In 4

%

have purchased between 1 and 5 consumer tech devices on Amazon In the last year

No Time Or Place Is Off Limits

Millennials are shopping on Amazon day and night, everywhere you can imagine

- Awake In the middle or the night 61%

- Working 57%

- Using the bathroom 47%

- Vacationing 38%

- Grocery shopping 24%

- Sitting in traffic 23%

- Intoxicated 19%

- Exercising 15%

Most Millennials Shop Via Mobile Device

%

shopped or consumer tech products on a mobile device

The Amazon App Is Visited Daily

%

use the Amazon app one or more times per day

Tech Purchases Outweigh All Others

%

of Millennials have made a Consumer Tech purchase on Amazon in the last year

Categories shopped on Amazon include:

- Consumer Electronics 61%

- Clothing, Shoes, & Jewelry 60%

- Beauty & Health 50%

- Toys, Kids, & Baby 43%

- Books & Audible 41%

- Home, Garden, & Tools 31%

- Pet Supplies 29%

- Sports & Outdoors 29%

- Other 13%

- Handmade 9%

Consumer Tech Purchases Are Driven By Prime

3 in 4 Millennials purchase consumer tech on Amazon for it’s prime shipping

Smartphones Are Least Likely to Be Purchased On Amazon

Smartphone purchases tend to hail directly from the brand for compatibility, pricing, and the assistance offered by brand retailers:

“

I’d likely buy a smartphone from the manufacturer because I’d want to be walked through the specifications and get advice.

“

For new smartphones, I would go directly to the store, so I can check out the product and choose from the variety. If I am looking to purchase a used phone, I might purchase it on Amazon.

Audio & Mobile

Shopped Most Over The Last Year

More than half of millennials have purchased headphones and/or mobile accessories on Amazon in the last year, while 1 in 3 have purchased speakers

- Headphones 54%

- Mobile Accessories (phone cases, etc.) 53%

- Speakers 34%

- Smartphone 29%

- Virtual Assistant (e.g. Amazon Echo) 27%

Amazon Offers Value Across The Customer Journey

Amazon isn’t just for making purchases: consumers use the platform tor discovering & researching products

%

Discover new products on Amazon

%

Research products on Amazon

%

Purchase products on Amazon

Millennials Turn To Amazon Search To Discover New Products

Half of millennials say their last consumer tech purchase was initially discovered on Amazon

Millennials primarily search for consumer tech on Amazon In the following ways:

- Product category 73%

- Customer reviews 55%

- Search by Brand 52%

- Best seller’ options 46%

- Filtering capabilities 46%

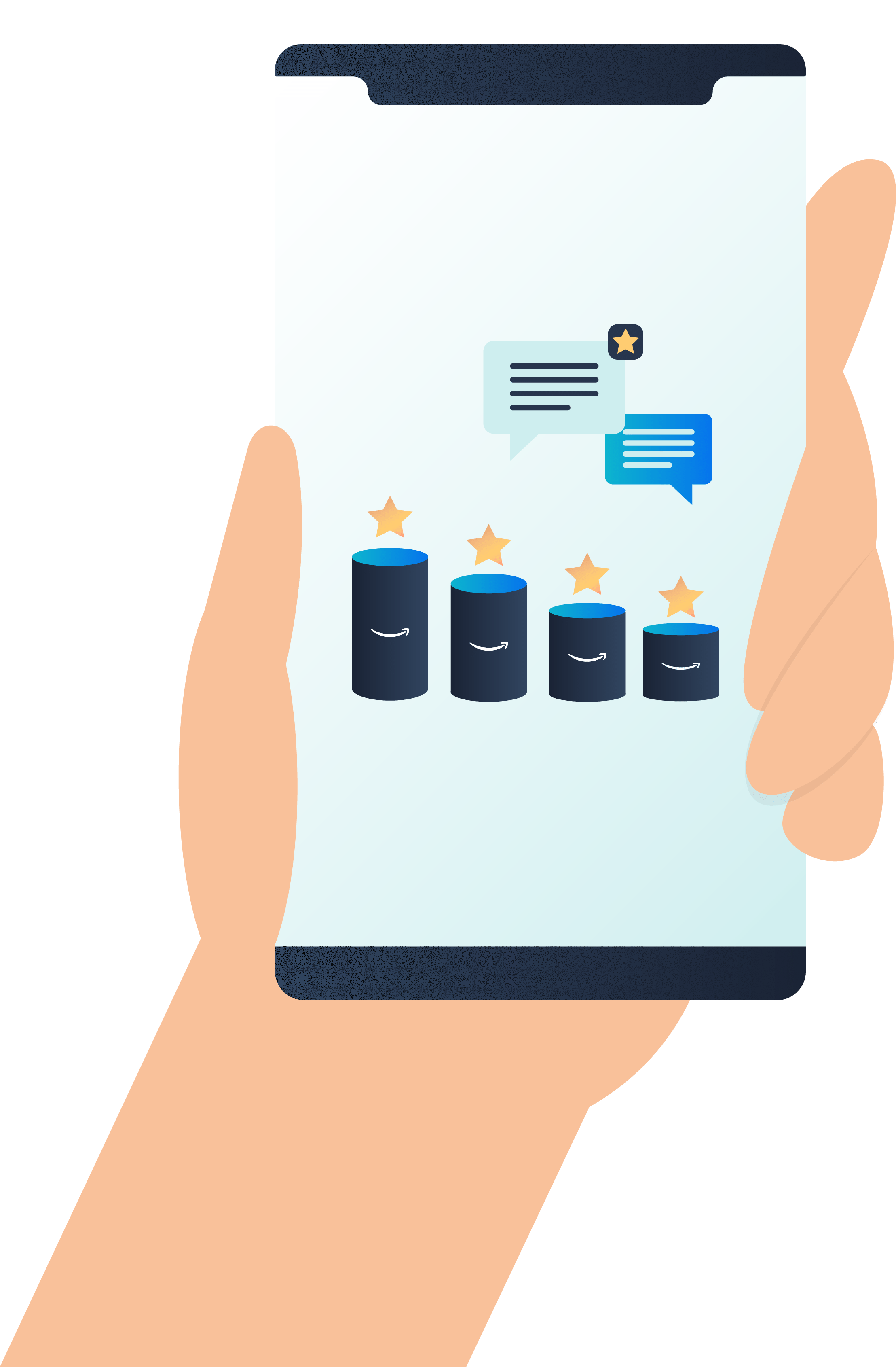

Customer Reviews Are Make or Break For Brands

- 55% of millennials search for consumer tech by using customer reviews

- Nearly 90% consult Amazon customer reviews frequently prior to making a consumer tech purchase

- 93% deem Amazon reviews important when weighing a purchase decision

Pros of Amazon customer reviews:

High volume/variety, objective and authentic

“

I’d likely buy a smartphone from the manufacturer because I’d want to be walked through the specifications and get advice.

Cons of Amazon customer reviews:

Fake reviews, vague and subjective

“

Low Star Ratings Will Not Fly With Millennial Buyers

A mere 8% of millennial buyers are likely to make a consumer tech

purchase on Amazon with a 3 star review, though purchase interest peaks

10 4/⅞ Where the ctAr count hits 4

Low Star Ratings Will Not Fly With Millennial Buyers

A mere 8% of millennial buyers are likely to make a consumer tech

purchase on Amazon with a 3 star review, though purchase interest peaks

10 4/⅞ Where the ctAr count hits 4

Outside Sources Drive Consumers To Amazon

Blogs and News Sites Are Key

Expert Reviews Prove Helpful

Brand Websites Offer Intel

to making a purchase on Amazon.

One Week Of Research Is Required

For Brands Looking To Engage With Amazon-Obsessed Millenials

Run consumer beta tests before launch to ensure your product is likely to hit the 4-star consumer rating

filled with quotes from media and clear competitive differentiators

consumers another point or reference during their research.

and is easily found through popularly searched keywords.

Lindsay Stuart

Laura Kauffmann

This research study is brought to you by the Business Intelligence Team at Max Borges Agency.

Survey data was collected from May 30 – June 14, 2018, whereby U.S. millennial consumers that purchased consumer technology products on Amazon in the past year were sought.